Client Bulletin: Interim 4th Quarter

With the recent downturn and continuing volatility in US stocks, we are reaching out to you with a mid-quarter update on portfolio performance, an overview of changes we have made, as well as our key observations on the current state of the markets. Please let us know if you would like to discuss any of this information further. We look forward to hearing from you.

US Stocks have now joined the rest of the world in an ongoing downturn: Most major US stock market indexes are down more than 10% from their most-recent highs in late September. In our latest commentary, we discussed the unlikelihood that US stocks would continue to so significantly out-perform the rest of the world. While we are surprised the shift occurred so quickly, we are not surprised it has happened.

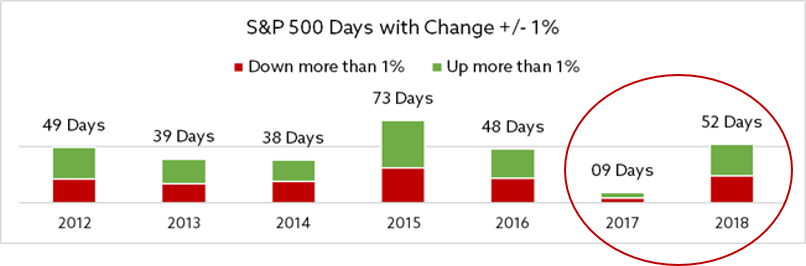

Volatility in US stocks is concerning, but not alarming: Current volatility is consistent with long-term market behavior. So far this year, the level of the S&P 500 has changed by more than 1% (up and down) a total of 52 days, compared to a total of nine such days during 2017. But, as shown in the chart right, this year’s volatility is much more “normal” than last year’s extraordinary calm.

No recession in sight, but economic and market headwinds are building up: The US economy is still growing at a reasonable pace heading into the holiday season, but we are keeping a close eye on key indicators. To name a few:

Unemployment is significantly low based on historical levels. The unemployment rate is typically lowest just prior to a recession.

Rising interest rates due to the Fed’s monetary policy, and the initial domestic impacts of trade tariffs are putting pressure on various areas of the markets and economy. For example, housing starts and building permits have slowed, and house prices have begun to deteriorate as a result of higher mortgage rates and the impact of tariffs on the price of building materials.

“Your portfolio is not the market”: Diversified client portfolios are holding up well against increased market volatility (see first chart, above). This is how we expect our portfolios to perform during market downturns.[1] We position portfolios for the long-term, meaning that portfolios are positioned for increased volatility before it occurs.

Besides protecting portfolios from the full-brunt of market downturns, this approach also allows us to focus on looking for opportunities rather than fighting for the exit. We are heavily focused now on finding individual stocks and possibly entire market segments of high-quality companies that have been priced down as a result of overall market conditions.Changes we have already made: Earlier this quarter, we made two significant changes to diversified client portfolios.

We exited High-Yield corporate bonds in favor of short-term US Treasury bonds. Because of high-yield issuers’ lower credit quality, investors demand higher interest rates (yields) from their bonds. We had become concerned that yields on these higher-risk bonds were too low, and concerned that low-credit-quality companies had been insisting on lighter restrictions on newly issued bonds with very little push-back from a yield -starved bond market.

The combination of low yields and easy credit is a slow-cooking recipe for disaster that we would rather avoid. To borrow a phrase from my partner and our CEO John Barnes, we have become increasingly concerned that the high yield bond market is “a bug looking for a windshield.” With yields on short-term treasuries now above the rate of inflation and above the dividend yield on the S&P 500, it made sense to shed the risk.We also reduced exposure to Emerging Market stocks in favor of high-quality dividend-paying Developed Market stocks. In our view, international stocks have declined reasonable levels based on historical data and relative to US stocks. But, numerous geopolitical uncertainties are rippling through global trade and driving sharp reactions from markets on a daily basis.

By re-allocating a portion of our emerging markets allocation to dividend-paying developed market stocks, we aim for portfolios to still benefit from the relative under-valuation of international stocks while limiting exposure to the heightened volatility of emerging markets like China, Russia, and India.

We value frequent communication with our clients, to discuss changing conditions and to ensure that we understand and stay updated on your objectives. We do not take lightly your patience or the trust you place in us as advisors, and we look forward to speaking with you soon.

Matt A. Morley, CVA, CEPA

Chief Investment Officer

[1] Please note: Each client’s portfolio is unique. The specific securities discussed vary in weighting across portfolios, and certain portfolios with strategic focus or investing constraints may not contain the holdings discussed herein. Portfolio style performance is calculated as an asset-weighted-average of portfolios within each style. Performance may vary across portfolios with similar styles, due to factors such as size and liquidity constraints.