Investment Commentaries: Third Quarter 2019

| Index Returns | 3rd Quarter | Year to Date | Trailing 12 Months |

| S&P 500 US Large Cap Index | 1.7% | 20.6% | 4.3% |

| MSCI All Country World Stock Index | -1.8% | 11.6% | -1.2% |

| Barclays Capital Aggregate Bond Index | 2.3% | 8.5% | 10.3% |

| US Core Consumer Price Index - (Inflation) | 0.8% | 1.8% | 2.4% |

*All figures as of 9/30/2019 unless otherwise noted

US markets continued higher in the third quarter, albeit at a slower pace and with more volatility. As we have mentioned in past quarters, the current economic expansion and bull market (by traditional measures) are now the longest in Post-WW II history. While the expansion continues, markets have begun to take indicators of slowing global economic activity more seriously. Heading into the final quarter of the year, we take a look at where the economy and markets stand, highlight threats to growth, and - most importantly – discuss what they mean for portfolios.

What is Going On?

First, the good news: consumers (which make up around 70% of GDP) continue to spend, inflation is below 2%, and unemployment is still near historic lows.

Consumption: As of the most recent data from July, Personal Consumption Expenditures are up 2.6% vs last year excluding the impact of inflation, Disposable Personal Income has increased by 3.6% over the same time period, and spending has grown despite the US Index of Consumer Sentiment ending the quarter at 96, slightly below the 98.3 level where it started the year.

Inflation remains at the Fed’s target rate of 2% by its preferred measured (12-month trimmed PCE Inflation) but is above the target as measured by the Consumer Price Index, which is 2.4% higher in July than the same month last year.

Unemployment currently sits at 3.5%; 0.3% lower than it was at this point last year. During that time, more workers have entered the workforce, and wages and salaries have increased by 6.3% in aggregate and 1.4% based on Average Hourly Earnings.

By these top-down measures of economic health, the US economy looks to be in good if not great shape. Yet, markets have become more volatile and business and investor sentiment has become cautious to somewhat negative. We believe this negativity is partially the result of some of the following threats:

Trade War: The Trump administration’s trade war with China continues, leading investors to dole fear and greed out to markets on a tweet-by-tweet basis. Tariffs are having a noticeable effect on a few sectors of the economy, but it is difficult to determine who is ultimately paying the price: US companies and consumers, or Chinese companies and consumers. What is clear is that markets dislike uncertainty, which is why any news seems like good news, so far.

Impeachment: An impeachment of President Trump resulting from recent interactions with Ukraine looks like a real possibility at this point, but the outcome for the President and any ripple-effects on markets and the economy are unclear. This uncertainty is likely to breed further uncertainty.

Brexit: Britain’s impending exit from the European Union (“Brexit”) continues to impact trade and markets both in and outside of Europe. After falling -0.1% in the second quarter, Germany’s economy is on the brink of recession. Regardless of whether its GDP falls for a second consecutive quarter sending it into a confirmed recession, it is difficult to argue that Brexit hasn’t played a big part in Germany’s slow-down.

Manufacturing Slow-Down: The economic slow-down is not isolated to Germany. Manufacturing has been slowing down across the globe, with Purchasing Managers Index (PMI) indicators in six of the seven largest global economies having fallen into contraction territory at some point in 2019. The US PMI is the only one still above 50 (the line separating expansion and contraction), but it has fallen consistently and significantly towards that line since late 2018

Attack on Saudi Arabia: On September 14th, a drone attack on Saudi oil infrastructure by an Iran-backed Yemeni rebel group shut down 50% of the country’s daily output and caused oil prices to jump over 15% on the Monday following the attack. Saudi Aramco says the facilities are up and running at full capacity, and oil is now priced at around its pre-attack price.

On its face, the market’s resilience against a shock to the system is a good thing. What concerns us is the source of the resilience: was oil’s quick return to lower prices indicative of confidence in the toughness of the oil market and global economy, or ignorance of the risk of more disruptions in a geopolitically volatile region?Lower Interest Rates: The Federal Reserve lowered the Federal Funds Rate by 0.25% in both July and September and could lower it again in October. Fed chair Powell’s recent statements imply that the rate cuts are pre-emptive, to sustain the expansion; but he has also repeatedly mentioned growing global economic uncertainty as a source of concern. The Fed does not usually lower rates in a strong economy, especially when its two primary benchmarks – inflation and the unemployment rate – are at or better than the central bank’s own targets for those benchmarks. Either they are seeing more substantial domestic headwinds than they are letting on, or they buckled under nagging pressure from the President to lower rates. Neither scenario is good for the long-term health of markets and the financial system.

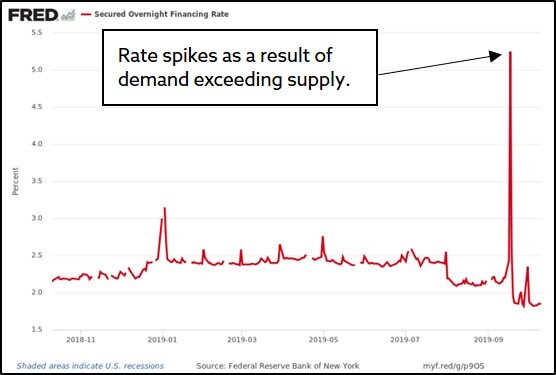

Quantitative Easing… Round Four?: In addition to lowering rates, the Fed has also begun buying short-term treasuries in an attempt to keep rates low and liquidity high in overnight lending markets. Specifically, the Fed has stepped in to lend to banks via repurchase agreements (“repo’s”). Repo’s take place when banks and other financial institutions in need of cash sell low-risk, short-term securities such as US Treasury bills and simultaneously agree to buy those securities back from the buyer at a set price the next day. The repo rate spiked when banks needed cash, wanted to use treasuries to borrow it, and no one showed up to take the other side of the trade.

Although the Fed insists its involvement in the repo market is not a form of Quantitative Easing, we are not so sure. The fact that the Fed must intervene suggests that there are kinks in the short-term lending market, a key source of stress in 2008 that eventually led to the credit and financial crisis. While we do not currently see the wide-spread excesses in lending that occurred prior to the last crisis, we are paying close attention to developments in short-term funding markets because short-term liquidity is the grease that keeps the gears of the economy spinning.

All of this and more boils down to the question we hear (and if we are honest with ourselves, we ask) the most: How long can this last?

The pessimistic view is that we have had a good run, but the economy is already headed for or in a recession.

The optimistic view is that this time is different, everything is fine and nothing can knock this record-breaking expansion off track because the economy has been regulated to perfection.

We believe the realistic view is that economies and markets are cyclical, not predictable: there will be a recession at some point and markets will likely decline meaningfully before and during it. Then, the economy will recover, most likely to be led by the market.

In hindsight many will say they saw the next recession coming. Some will even say they knew when and why it would start and how bad it would get. We work to be able to look back and demonstrate that our clients’ portfolios were ready for a recession and ready for what came after. Portfolio management requires a long-term view. Despite the longer-than-usual expansion we are experiencing now, we know that long-term periods include both expansions and contractions; bull markets and bear markets. We have been working to make sure portfolios are positioned to continue benefiting from strong performance of stocks while limiting exposure to riskier segments of the market and preparing to take advantage of opportunities that result from short-term periods of higher volatility.

Another very important piece of managing portfolios for the long-term is how we communicate with you - our clients – to prepare you for the possible impact of a market downturn on your portfolios, and what it could mean in the context of your investment objectives. To that end, when we meet with you this quarter, we will be bringing a “portfolio stress test” specific to your portfolios. The report will use historical data on markets, your portfolio, and its current positioning to illustrate the likely effect of a recession and market-downturn on your wealth. Based on our experience through the last recession, knowing what to expect and knowing your portfolio is prepared for it is the key to maintaining peace of mind about your wealth through volatile seasons.

As usual, our client-service staff will be reaching out to you soon to schedule a meeting. If you would like to set up a meeting sooner, please contact us at your convenience. We would love to hear from you, because we value frequent communication with our clients. We appreciate your patience and the trust you place in us as advisors, and we look forward to speaking with you soon.

Matt A. Morley, CVA, CEPA

Chief Investment Officer